We understand the dedication, vision, and effort behind the inception of your business.

Let’s partner together in the next chapter of your company’s journey.

What sets us apart is that we fully immerse ourselves in every detail of your company, seeking to enable you with differentiated approaches to build category-defining businesses.

$1.2B

$0B

Assets under management

2021

2021

Founded

$150M+

$0M+

ARR across our portfolio

125%+

0%+

Average growth

rate since entry

Exclusively focused on partnering with founders to grow & scale exceptional software companies into category leaders.

We are nuanced in our approach, with the ability to flex between control-oriented and minority partnerships, striving to find the right solution for your business.

01.

Growing vertical software businesses that are typically founder-owned and seeking first-time growth capital

02.

A software solution purpose-built to serve an industry need

03.

Finding the right partners to roll up our sleeves with in pursuit of sustainable growth and scale

We are nuanced in our approach, with the ability to flex between control-oriented and minority partnerships, striving to find the right solution for your business.

01.

Enhancing your go-to-market motion

02.

Upleveling your product offering

03.

Strengthening or building a leading management team with key organizational hires

04.

Leveraging M&A opportunities to build scale and product depth

Press: Announcement

December 16, 2025

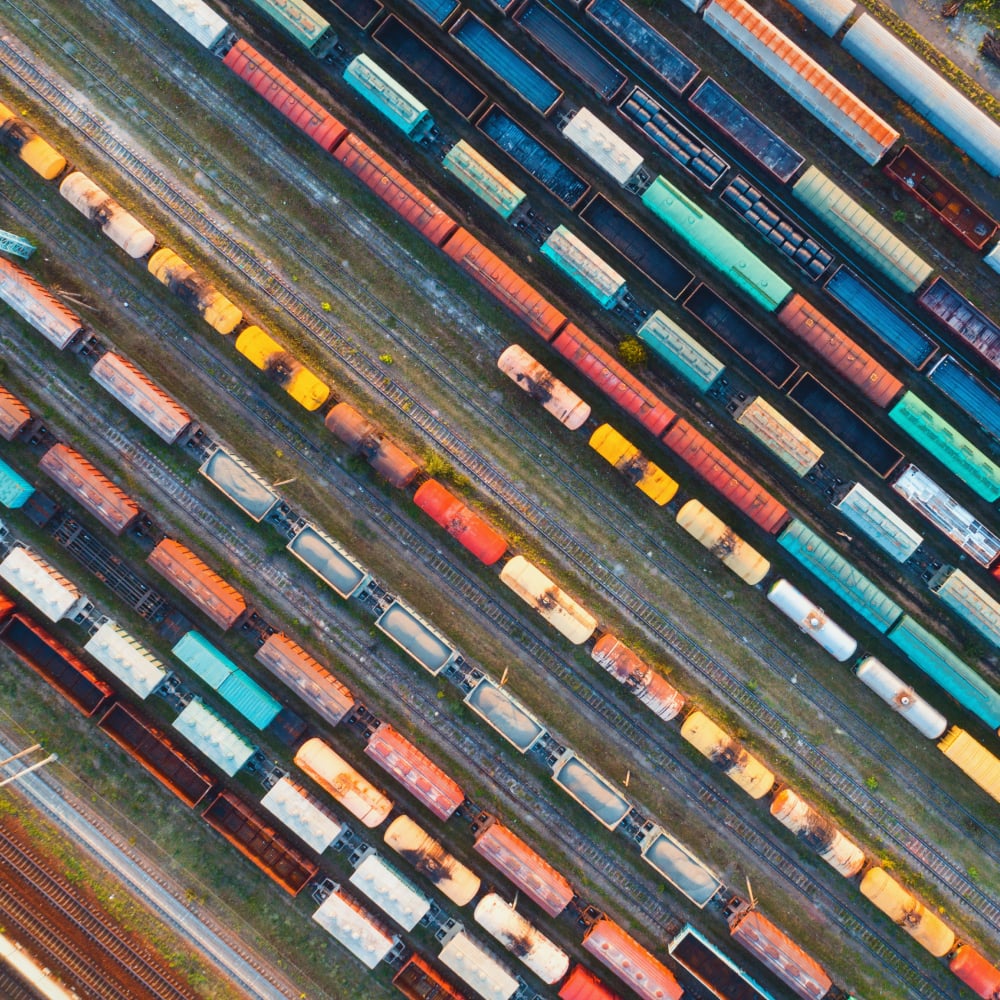

Cedar AI, a Leading AI Transportation Management System for Railroad Operators and Shippers, Receives Strategic Growth Investment from Nexa Equity

News

October 27, 2025

Nexa Equity Further Strengthens Founder-First Focused Team Through Additions to Investment and Operating Bench

Press: Press: Business Wire

August 13, 2025

Facility Grid, a Leading Commissioning and Operational Readiness Software Provider, Receives Growth Investment from Nexa Equity